Financial Management – The SARS piece of the pie

Income tax is the bane of our business and personal existence, but as upright citizens, we have to pay it. And the time of payment creeps up on us unexpectedly at least twice a year. Provisional tax is paid in Aug and Feb of every year. But those payments are not the actual tax expense that is reflected in our accounting records. Only at the end of the financial year, once all the accounting activities have completed and we have a set of annual financial statements, can we say exactly what profit (or loss) has been made, and therefore exactly what tax is due. Thus, your annual income tax return is a reflection of the final picture for the year.

Against this final financial picture is laid the provisional tax that you have paid during the year to see if you have over/underpaid. Typically the provisional tax is shown as an expense in the financial year until the final accounting entries to calculate the total tax for the year. Then the over/underpayment of tax is added/subtracted to make the tax expense account tie-up with the tax return. Any overpayment (where you paid too much provisional tax) is then shown on the balance sheet as a receivable, but if you owe SARS a bit extra in tax, this will reflect as payable in the accounting records.

It sounds like you only have to think about income tax a few times a year, but if you don’t plan for it, you can end up without enough money to pay it. We suggest putting an estimated amount aside in a separate account every month, to make sure you have enough money to pay SARS. To know what to estimate, you need a good and accurate idea of your monthly profit.

To help you stay on top of your estimated tax bill, give us a ring.

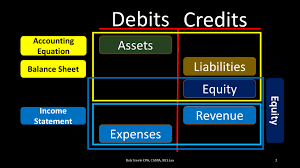

Is accounting only a matter of debits and credits

Often times some businesses do not value the importance of bookkeeping and accounting. Statements like bookkeepers do not bring the money so I can do without one are often heard. What most business owners fail to understand is even though bookkeepers and accountants do not bring in the money, they provide very vital support to any business.

Bookkeepers and accountants are trained to keep accurate records of transactions happening in any organisation. This information once captured into the entity’s accounting package is then used to draw up management report that is given to management and business owners so they can see at a glance how the business is performing. In short so they can see how their efforts are paying.

Bookkeepers and accountants do not just debit and credit accounts simply because for every debit entry there has to be a credit entry and vice versa, no. They have to follow certain acceptable financial reporting standards when they do the capturing and processing of financial information in the accounting package. This requires a lot of knowledge and ongoing continued professional development as changes in standards are brought in every now and again.

This is then used by different users of financial statements which vary from prospective Investors, banks if the entity wants to borrow money, shareholders etc.

We may not agree but accounting is the heart of a business. Without proper record keeping, how is a company going to know what their liabilities are and who owes them? Some transactions might just fall through the cracks. Remember we have among us some companies that will only pay upon presentation of an invoice and if the entity does not know who still owes and how much some money might never be received.

Financial Management – The price of borrowing

In the profit and loss statement, there is a category of costs we haven’t yet discussed. These are the financing costs. They are a separate section of costs as they are not generated by the operations of the business, or the production of your product or service. The financing costs related to how you fund the ‘vehicle’ that is the business and are usually made up of interest paid to the provider of the funds. Interest is normally paid on the following types of funding:

- overdraft on business accounts

- short-term loans from the bank or other lending agencies

- higher purchase agreements for vehicles, equipment and other assets

- loans from members, directors or shareholders and their families

Finance costs do not increase in relation to sales or business growth, but rather are linked to the size of the funding received, the repayment period and the national interest rate. Financing of some kind is often necessary at some point in a business’s life; overdraft being the most common. When the cost of that additional inflow of cash is separated out and highlighted in the financial statements, how much is actually costs can be a surprise.

Deciding to access funding, in whatever form, should be a careful consideration, as the monthly commitment to repayments can be a challenge, and the cost can be crippling. The need for a continual inflow from an outside source means that the business is not generating enough cash to sustain itself and that something in the business operations needs to change. Rather than increasing costs through additional financing, a business owner should always look at ways to increase access to the cash available within the business first.

Should you wish for some outside insight into maximising available cash within your business, please make an appointment with one of our consultants.

File Returns or else….

Having received SARS’ current press release declaring non-submission of tax returns a crime, I realised it is quite possible to live an innocent life without stealing from anyone but find oneself at the wrong end of the law. SARS declares that the courts would declare one guilty by omission if they fail to file their tax returns. Unlike Spain, the United States and other nations; South Africa has never had any high-profile cases of non-compliance with local tax laws.

When we think of tax crimes globally, high profile names in sports and the entertainment world come to mind. Like Wesley Snipes, who failed to submit tax returns from 1999 to 2001. This resulted in the fiscus being deprived of US$7m in taxes, resulting in a three-year jail sentence. Other high profile individuals who were convicted for failure to file tax returns are Jeffrey Atkins (famously known as Ja Rule), Joseph Cartagena (Fat Joe), Dolce & Gabanna (exonerated in 2013) e.t.c resulting in huge fines and prison sentences.

In SARS recent press release they explicitly declare the criminality of failing to submit tax returns and that they have engaged the National Prosecuting Authority in order to facilitate the prosecution of would-be offenders. This could be an individual who fails to submit their returns may end in prison or being fined; resulting in a criminal record. This would affect several professionals whose occupations require that they should not have criminal records. SARS also fired warning shots at prominent South Africans who have not filed their tax returns. It is clear that they are not too far from the reach of the long arm of the law.

These far-reaching measures were necessitated by an increase in non-submission of tax returns. At the end of March 2018, SARS’ Outstanding Returns Book showed that 30 million returns were outstanding from active taxpayers. SARS did emphasize that criminal prosecution will be applied as a last resort; after all other measures to ensure compliance have been exhausted. All the individuals who will appear in court have been engaged beforehand and had been issued with final demands. A good example of the conviction of Mr S. Ragunat in Port Shepstone. As a representative of SPS Distributors, he paid an R5,600 fine for the non-submission of 50 tax returns for VAT, PAYE and Corporate Tax. He has since complied.

Going forward, it is prudent to ensure all tax returns are filed on time and to work towards filing any outstanding returns to avoid prosecution. It appears SARS phone calls on outstanding returns and final demand notices can no longer be taken lightly. The grey-area has always been for those below the income tax thresholds and companies registered for PAYE but currently, do not have employees. For the former, it is advisable that you file tax returns regardless of your income to avoid SARS penalties as what happened last year. It will be difficult 3 or 4 years later to prove to SARS that you were below the tax threshold as the documents may no longer be accessible. If the company is registered for PAYE and currently has no employees, it is advisable to continue filing nil returns until the position changes for the company. As for those who chose to bury their heads in the sand and complicit taxpayers, well the whip has been cracked and you may find oneself behind bars.

Financial management – how much is enough?

In the last blog, we looked at the operating costs of the business. We understood that these are the fixed costs of running the business that needs to be covered every month by the sales. In your budget, you’ll have put the sales revenue needed to make a profit, as your monthly or annual target. However, do you know how many products or days of service you need to sell to make that target? That number, the number of units sold to pay the operating costs, is called the Breakeven Point. How many sales are required for your income to equal your costs?

For this calculation, you’ll need one of the numbers previously discussed in this series – the gross profit per item. Since the cost price of your product is paid out of the sales income, only the profit on that item is available to contribute to covering the operating costs. To calculate the breakeven point you will need to divide your operating costs by the average gross profit. This will give you the number of products necessary to be sold in order to cover your costs.

What if you are a service business? Do you know how many staff you need to break even? Generally service business employs staff when the workload is too great for the current complement. However, it is important to calculate the optimal number of staff to cover costs and generate a profit.

First you have to calculate the gross profit on sales by deducting the average hourly cost for the employees from the average hourly charge out rate. It may be useful to do this per service type or employee group, if the rates differ vastly. Then you are able to divide the operating costs (net of the employee’s remuneration costs) by the average profit per hour to calculate the total number of chargeable hours to be worked to breakeven.

It can be helpful to then work that back into the number of full-time staff necessary to work those hours. To calculate the available chargeable hours, start with the calendar year, less weekends and public holidays, leave and staff development days, staff meeting time and general unproductive time. Typically it works out to less than 200 days of chargeable time per person. Divide the breakeven hours into days and divide by the number of available days for 1 person to calculate how many staff members you need. You might be surprised at how many staff members you require!

There are a lot of numbers in these calculations, and since we find numbers to be fun, give us a call if you need help with the numbers!